Individual actions can dramatically shape a company’s trajectory. Words spoken in a single moment can topple empires built over decades. Ethical missteps by one person often cascade into full-blown corporate meltdowns that leave thousands jobless.

This article explores ten jaw-dropping cases where one person’s decisions changed everything. Each story works as a business cautionary tale more dramatic than most Netflix documentaries. You’ll discover practical ways to avoid these spectacular fails in your own career.

10. Gerald Ratner: The Cost of Candor

By 1991, Gerald Ratner had transformed his family’s modest jewelry business into a retail giant with 2,500 stores across the UK. His empire generated annual sales exceeding £1.2 billion and employed thousands of people.

At the Institute of Directors annual conference, Ratner told the audience his company sold “a pair of earrings for under a pound, which is cheaper than a prawn sandwich from Marks & Spencer, but probably wouldn’t last as long.” This joke triggered an immediate stock plunge, with company value dropping by £500 million virtually overnight. Consumer trust evaporated like ice cream on hot pavement.

The jewelry chain eventually rebranded, desperately trying to distance itself from its founder’s catastrophic comments. To this day, the “Ratner Effect” describes any self-inflicted PR disaster where a leader publicly trashes their own product.

9. Eike Batista: The Perils of Overpromising

Rising rapidly in Brazil’s energy sector during the early 2000s, Batista’s OGX Petróleo announced major crude oil discoveries that captivated investors worldwide. His promises of grand infrastructure projects and unprecedented returns attracted billions in investment capital.

But Batista’s empire turned out to be shakier than a chocolate soufflé in an earthquake. Overspending and dramatically unmet production promises fueled a devastating decline, with his company regularly missing targets by margins that would make even politicians blush.

When OGX finally filed for bankruptcy in 2013, it represented a $2.1 billion loss for investors. Batista later faced corruption charges and received a 30-year sentence, though this was eventually overturned on procedural grounds. (Funny how rich people’s convictions often have more loopholes than a crochet pattern.)

8. Martin Shkreli: The Pharma Bro Debacle

Martin Shkreli acquired Turing Pharmaceuticals in 2015 and immediately raised the price of Daraprim—a 62-year-old drug treating toxoplasmosis in HIV patients—from $13.50 to $750 per pill overnight. This staggering 5,500% increase sparked international outrage and a masterclass in how to become America’s most hated man overnight.

Rather than attempting damage control, Shkreli’s combative social media presence and unapologetic attitude further inflamed tensions. He appeared to relish his villain status, purchasing a one-of-a-kind Wu-Tang Clan album for $2 million while refusing to reduce medication prices.

Though Shkreli eventually faced conviction on securities fraud charges unrelated to Turing, his pricing decision remains a defining moment in healthcare ethics debates. The company rebranded but later filed for bankruptcy, unable to escape its founder’s toxic legacy.

7. John Meriwether: The Limits of Rationalism

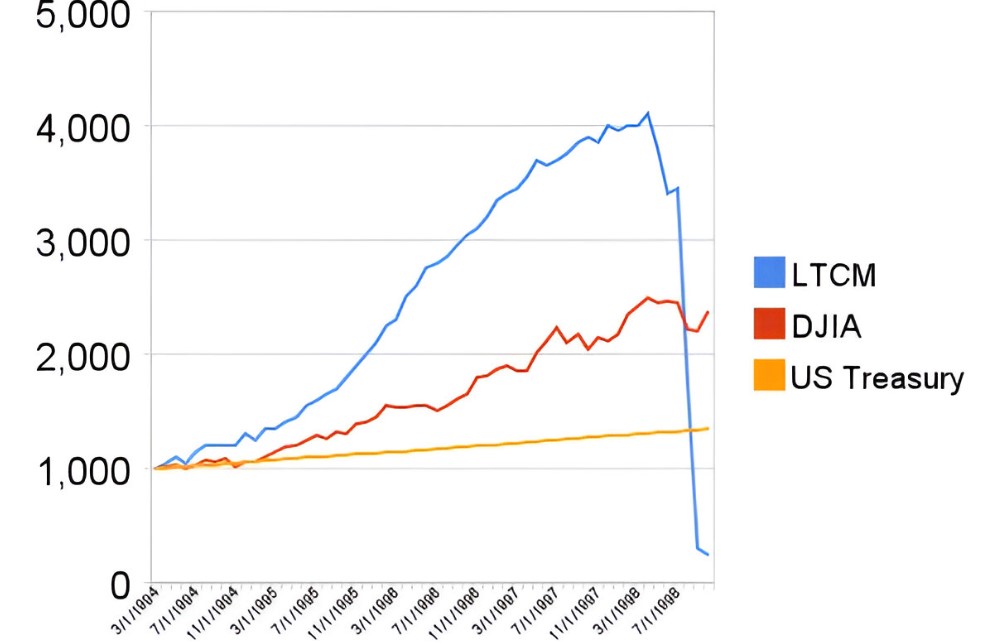

Founded in 1994, John Meriwether’s Long-Term Capital Management (LTCM) hedge fund assembled an impressive team including Nobel Prize-winning economists. Their sophisticated mathematical approaches to trading generated extraordinary profits during the early years and attracted billions in investment.

But the markets turned out to be as predictable as cats on catnip. The 1997 Asian financial crisis and 1998 Russian debt default created market conditions their models never anticipated, crippling LTCM’s positions and threatening the broader financial system.

The Federal Reserve ultimately orchestrated a $3.6 billion bailout involving 14 major banks to prevent market collapse. The fund dissolved amid widespread financial turmoil in 2000, and Meriwether’s later venture also failed during the 2008 financial crisis. (Apparently lightning does strike twice when you’re standing on a mathematical golf course during a storm.)

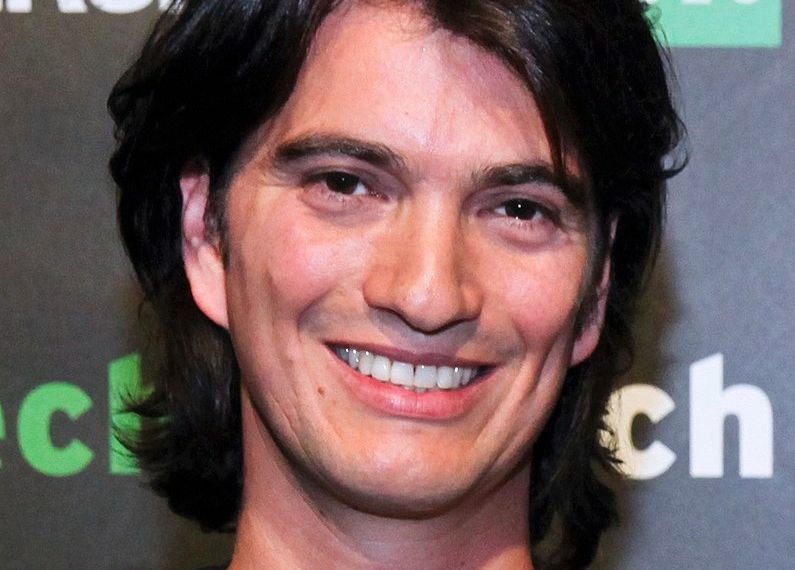

6. Adam Neumann: The Eccentric Fall of WeWork

As co-founder and CEO of WeWork, Adam Neumann cultivated an almost messianic image among employees and investors. His eccentric behavior—including barefoot meetings, tequila shots during workdays, and corporate retreats featuring celebrity performances—initially seemed part of a revolutionary corporate culture.

However, personal indulgences soon undermined WeWork’s credibility like termites in a wooden skyscraper. Neumann purchased a $60 million private jet for company use while simultaneously laying off employees, and registered the “We” trademark personally before charging his own company $5.9 million for its use.

Fundamental concerns about WeWork’s business model—essentially taking long-term leases and subdividing them into short-term rentals—further delayed the company’s highly anticipated IPO. When financial disclosures revealed staggering losses, Neumann was removed as CEO in 2019, and WeWork’s valuation plummeted from $47 billion to less than $8 billion in weeks.

5. Aubrey McClendon: The Reckless Billionaire

Aubrey McClendon transformed Chesapeake Energy through innovative drilling methods and aggressive land acquisition during the American fracking boom that redefined global energy markets and created fortunes overnight.

His approach to business blurred personal and corporate boundaries in troubling ways, with his personal finances becoming entangled with company lenders. He borrowed over $1 billion using his Chesapeake stakes as collateral, creating significant conflicts of interest that eventually led to his dismissal in 2013 amid shareholder revolt.

In 2016, McClendon faced indictment on conspiracy charges related to oil and gas lease bid rigging. Just one day after the indictment, he died in a single-car accident, adding a tragic dimension to his controversial legacy. Chesapeake Energy faced significant financial volatility in subsequent years, ultimately filing for bankruptcy protection in 2020.

4. Mike Lazaridis: The Blackberry Missed Opportunity

BlackBerry achieved remarkable early success under Mike Lazaridis, becoming the essential business communication tool of the early 2000s. The distinctive devices with physical keyboards and secure email capabilities dominated corporate markets worldwide, with even President Obama refusing to surrender his BlackBerry upon taking office.

However, RIM fatally failed to adapt after Apple’s iPhone debut in 2007. Lazaridis famously dismissed touchscreens, telling reporters, “Try typing a web key on that.” The company’s culture turned out to be more rigid than a frozen keyboard in winter.

While competitors embraced app ecosystems and consumer-friendly designs, BlackBerry doubled down on enterprise security and physical keyboards. After years of declining relevance, BlackBerry discontinued its phone hardware business entirely in 2022, marking the end of an era. (Somewhere, a lone executive still clutches their Bold 9000, refusing to upgrade.)

3. Frank Lorenzo: The Labor Dispute that Grounded Eastern Airlines

Frank Lorenzo acquired the struggling Eastern Airlines in 1986, implementing aggressive cost-cutting measures that sparked intense conflict. His approach resembled trying to fix a leaking boat by drilling more holes in the hull, with harsh policies toward pilots, mechanics, and flight attendants creating widespread unrest throughout the organization.

When machinists struck in March 1989, pilots and flight attendants joined in solidarity. The resulting operational paralysis crippled Eastern’s ability to serve customers and generate revenue, with daily flight cancellations and customer service failures becoming routine.

FAA fines for safety violations further damaged the airline’s already fragile credibility. These compounding problems led Eastern Airlines to declare bankruptcy, representing one of the most devastating failures in American aviation history and highlighting the enormous cost of neglecting employee relations during corporate turnaround efforts.

2. Nick Leeson: The Rogue Trader of Barings Bank

As a derivatives trader for Barings Bank—Britain’s oldest merchant bank—Nick Leeson took increasingly unauthorized risks that ultimately destroyed the 233-year-old institution. Stationed in Singapore in the early 1990s, he invested heavily in futures contracts tied to the Japanese Nikkei index.

When these positions began generating losses, Leeson created a secret error account—numbered 88888—to hide the mounting shortfalls from London headquarters. This deception continued for years, with losses growing like mushrooms in a dark, damp basement. Each attempt to conceal the problem only made the ultimate revelation more catastrophic.

The 1995 Kobe earthquake destabilized Asian markets significantly, creating losses too massive to hide. When Barings executives finally discovered Leeson’s fraudulent activities, the bank faced more than £827 million in losses—twice its available capital. Barings Bank collapsed completely and was acquired by Dutch bank ING for just £1.

1. Bernard Ebbers: The Accounting Fraud at WorldCom

Bernard Ebbers led WorldCom’s dramatic growth from regional telecom provider to industry giant through numerous acquisitions during the 1990s. WorldCom’s stock soared, making Ebbers a billionaire and business media darling.

However, pressure to maintain growth led to massive accounting fraud that made Enron’s shenanigans look like amateur hour. The company began classifying ordinary operating expenses as capital investments—a manipulation that artificially inflated earnings by billions. Federal investigators eventually uncovered $11 billion in fraudulent accounting entries—the largest corporate fraud in American history at that time.

Ebbers received a 25-year prison sentence for his role in the fraud, though he was released on compassionate grounds shortly before his death in 2020. Verizon eventually acquired the reorganized company’s assets, but WorldCom’s collapse destroyed billions in shareholder value and thousands of jobs. (The company’s accounting practices redefined “creative math” in ways that would make even tax attorneys blush.)