The guitar market in 2025 resembles a fever dream designed by economists with questionable taste in music. New prices climb faster than a Steve Vai solo while used values plummet like a dropped pick. Smart buyers who decode these contradictions will score legendary deals that make vintage store browsing feel like treasure hunting.

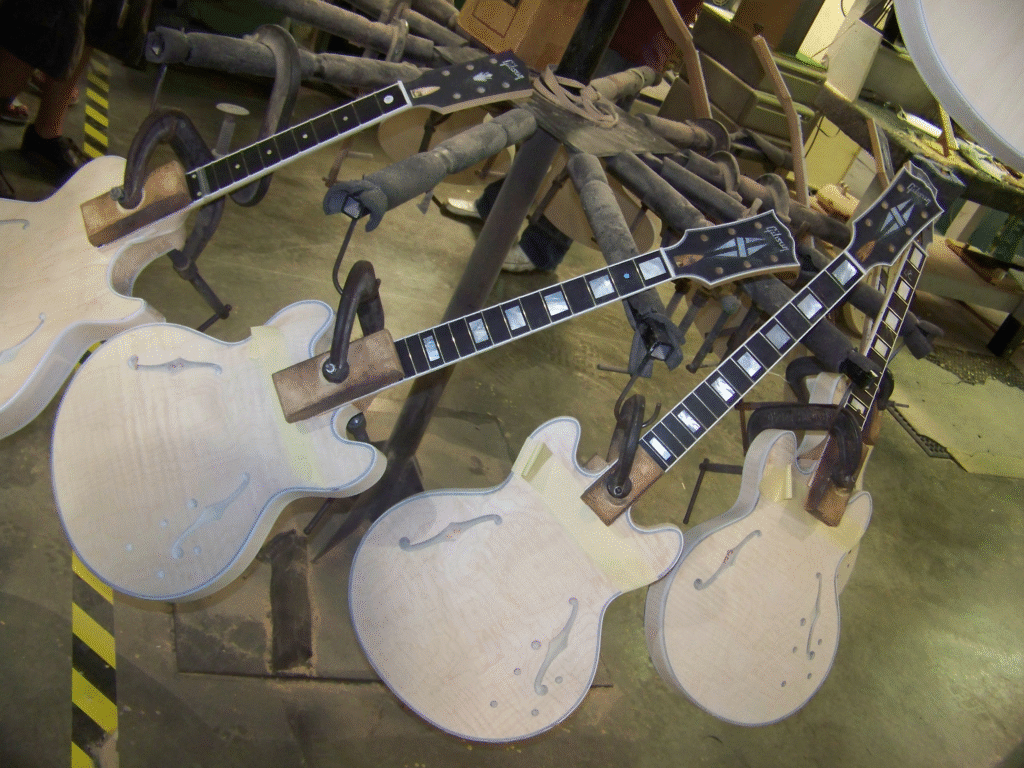

7. Smart Manufacturing Strategies Emerge

Demand-driven production replaces wasteful warehousing practices that once defined guitar manufacturing. Retailers poll anticipated orders before manufacturing begins, creating custom production runs tailored to market appetite.

PRS pioneered this approach, followed by smaller boutique builders now delivering guitars that match market demand. Gone are massive inventory stockpiles gathering dust while popular models sell out instantly.

6. Digital Pricing Creates New Loopholes

Minimum Advertised Pricing attempts to standardize retail costs across platforms, but geo-targeting technology undermines these efforts completely. Online retailers display variable prices based on shoppers’ locations and browsing history.

Inconsistent enforcement weakens MAP’s intended market equity as algorithms determine pricing dynamically. Some retailers quietly circumvent rules through membership programs and flash sales in legal gray areas.

5. Used Prices Are Crashing Hard

Guitar instructors nationwide report unprecedented floods of barely-touched instruments hitting secondhand markets. Pandemic-era enthusiasts bought guitars faster than they learned power chords.

A 2019 Gibson Les Paul that sold for $2,800 new now appears on Reverb for $1,900. This dramatic drop might remind collectors of how rare and expensive guitars have historically surged or slumped in value depending on shifting trends and market demand.

High quit rates created a massive oversupply across established brands. Quality instruments at reduced prices create opportunities for savvy players willing to sift through the digital marketplace noise.

4. Tariffs Create Market Chaos

Trade policies inject instant volatility into guitar pricing that makes cryptocurrency look stable. Import tariffs can spike costs up to 25% overnight, particularly devastating budget-conscious brands like Epiphone and Squier.

Asian manufacturers face the heaviest impact, forcing retailers to stockpile inventory before potential price explosions. Consumer confidence wavers as purchase decisions become timing gambles rather than simple want-versus-need calculations.

3. Guitar Shops Deploy MAP Workarounds

Physical guitar shops provide what algorithms cannot replicate: tactile connection with instruments and expert guidance from passionate professionals. However, savvy shops navigate Minimum Advertised Pricing through creative bundling strategies.

Smart retailers offer “setup packages” that discount guitars through included services, accessories, or trade-in bonuses. This maintains MAP compliance while providing real value that online retailers cannot match.

2. New Guitar Prices Keep Climbing

New guitars cost more than your first car, and manufacturers aren’t apologizing. Material costs and supply chain chaos drive legitimate price increases beyond simple corporate greed. Tariffs threaten another 25% jump if trade policies shift unfavorably.

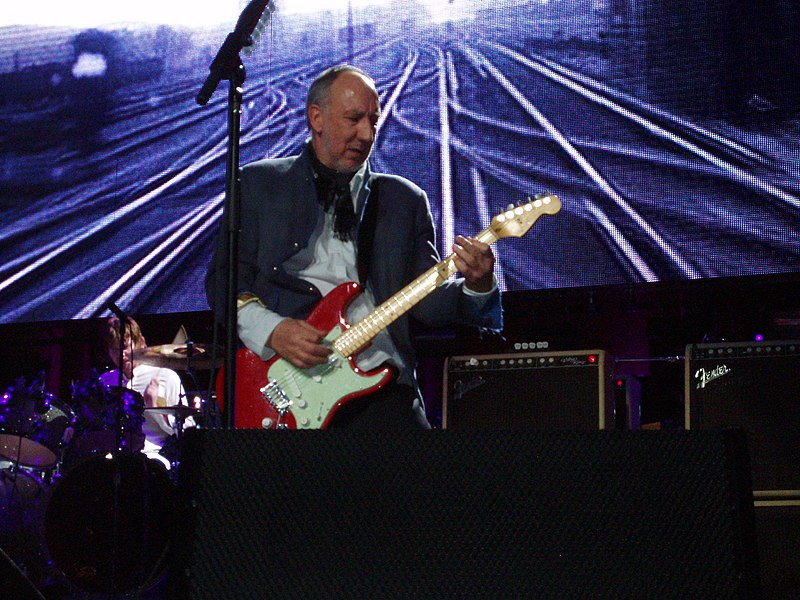

As brands innovate with alternative materials and new models to maintain quality and control costs, it’s worth noting how today’s evolving market still caters to legends and newcomers alike, much like the top 100 greatest guitarists who’ve defined what these instruments can do across generations.

1. Strategic Timing Beats Impulse Buying

Purchasing guitars in 2025 requires strategic thinking rather than emotional decisions. Multiple contradictory forces create complexity that challenges even experienced buyers navigating this landscape.

Set Reverb alerts for target models, build relationships with local shops before major purchases, and time acquisitions around quarterly inventory cycles. Trusted guidance becomes invaluable when market signals conflict across platforms and pricing structures.